The new financial year has started with some good news for taxpayers. The proposed changes to the Low and Middle Income Tax Offset (LAMITO) have now become law. This will mean extra money in taxpayer’s pockets each pay period going forward, as well as a boost to refunds when they lodge their 2018/19 tax returns

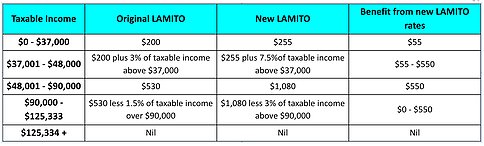

As part of the 2018/19 budget the Government announced in May 2018 a staged 7 year ‘Personal Income Tax Plan’ was introduced. The plan included the new LAMITO which would be available alongside the existing Low Income Tax Offset from 1 July 2018. The offset allowed for a maximum $530 non- refundable reduction in tax for those earning up to $90,000. The offset phases out completely at $125,333.

The LAMITO is being referred to as the ‘Lamington’ by some because of the similarity in name and ‘sweet taste’ it will leave with taxpayers.

The original LAMITO was passed as law in June 2018. This meant that tax withheld by employers from July 1 2018 should have taken into account any relevant reduction in tax as part of the LAMITO.

30 mins Free Consultation

In the Call, you will get:

- Review your current financial situation

- Review your current tax position

- Discuss investment goals

- Tax minimisation strategies

As part of the 2019/20 budget the Government announced further changes to the LAMITO. The changes mean an increase to the minimum offset from $200 to $255 as well as an increase to maximum offset from $530 to $1,080. Importantly, the changes are retrospective, so will apply from 1 July 2018. Anyone entitled to the maximum LAMITO should automatically be $550 in front when it comes to lodging their 2018/19 tax returns.

What to expect from the LAMITO changes.

It is important to note that the benefit for the 2018/19 year will only be realized when you lodge your tax return. So don’t delay, book an appointment with Private Wealth Accountants today.

I hope this article helps you learn more about your tax return.

Conclusion

I have shared with you the Top 4 Tax Deductions that Most People Miss. I hope that this article can help you better understand what you can claim to increase your tax refund.

If you have any question, free feel to email us at admin@privatewealthaccounts.com.au or call us at (03) 9973 5905. We are here to help.